One thing that I have never been good with is money

So much so that I now have none at all

I am almost 39 years old

I have no savings

No property

No assets at all

That is partly through choice

Because I do not trust myself with money

Though I think I would be much better now

Than I ever have been in my life

Because it is no longer about me

It is about the future

My children

My grandchildren

Making sure they are cared for

Making sure we can help them whenever they need

Thankfully David is incredibly good with money

And when our children are grown

And I begin to earn serious money again

It will be he who will remain in charge of the family finances

He who will keep account and control

And even if I had a glowing financial history

I think this is actually the way that he likes it

And it is the way that I like it too

Though my best friend has always said to me

Keep a bank account of your own

Put a little bit of money away each month

A financial safety net of your own

Just in case

Of course, being me I have not followed that advice

David and I do have separate accounts

He gives me money each month to make sure

The children are clothed and fed

And entertained

I do not keep any aside for myself

My parents helped me out of trouble a lot

In my younger years

And I will always be grateful that they did

But I also wish I had learned more about money

About spending and saving

Budgeting and borrowing

I wish we had more conversations about options

Ideas of how to make money last and grow

How to use it wisely

The very real consequences if you don’t

I think these are all things I had to find out on my own

David and his Dad have a very different relationship

Perhaps because he has never been a trouble

I do not know

But they talk about stocks and shares

ISAs and interest

Best case and worse case

Planning and forecasting

David will always talk through his plans and ideas with his Dad

In a way I want Esther, William and Bea to talk to us

To learn from us and with us

To feel able to argue with us and us with them

Without it being heated, horrid or hurtful

I think it is important to be able to have these conversations

To be able to offer advice

To accept that sometimes the advice may not be taken

But to know that we have tried

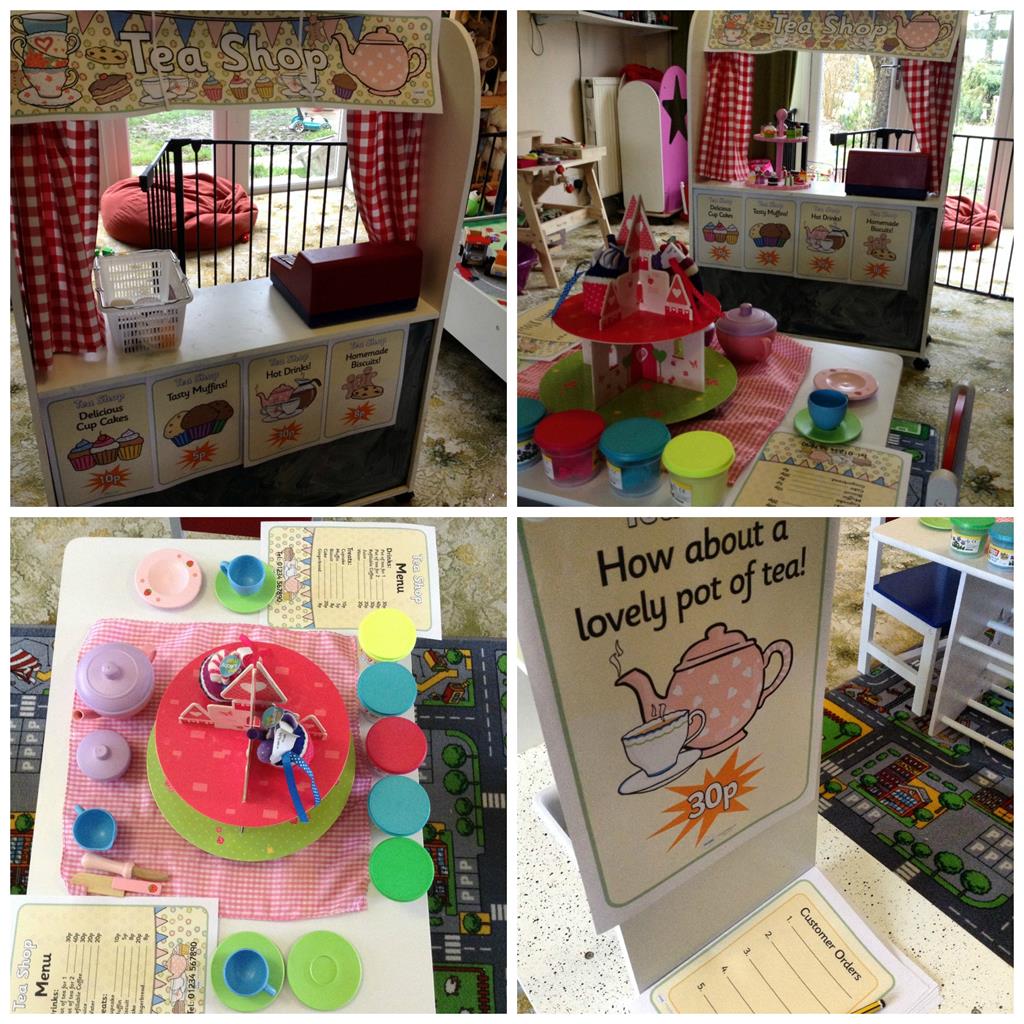

Esther and William are 5 this year

They currently have no concept of money at all

They know that you need money to buy things

But have no clue how much they can buy

And with what

They do not appreciate the difference between a penny and a pound

That is something that I want to change

Our children will get pocket money when they are older

My plan is to get the first year of school under our belts

And then begin to think about chores and payment

Pocket money

I want them to save money for an item they would like to buy

To do that they need to appreciate how much money things cost

At the moment I do all of our shopping online

I am thinking that I might start to do some shopping each weekend

In our local village shops

So Esther and William begin to see the exchange

Money for goods

Goods for money

And start to understand how buying and selling works

Time is passing so quickly

It will not be long before my tiny twosome

Are opening bank accounts of their own

And what then?

What advice will we offer them then?

What then will we want them to know about money?

Much the same as we will instill in them from the start I think

Spend your money wisely

Only buy things that you really want or need. Think carefully before you buy something. Look at different buying options. Make sure that what you buy is really worth the money that you spend.

Save for a rainy day

We never know what might happen in the future. It is good to have a pot of money put to one side for emergencies, for surprises. A safety net, redundancy. It is good to have it there.

Save for something special

If there is a larger item, a special item that you really want but cannot afford. Save up for it. Save as much as you can and then when you have the money buy the treasured item. You will feel proud and a real sense of achievement for doing that rather than getting into debt or asking someone else to buy it for you.

Keep your money safe

When our children start to have a little money of their own, I will also buy them each a wallet or purse. They already have money boxes where they keep any coins that they find lying around the house. From the beginning we will talk about where to keep money and when the time is right we will help them to choose an appropriate current account.

Think of ways to make and save money

There are always ways to save money. Join the library instead of buying new books. Grow fruits and vegetables to eat. Make up picnics instead of buying food out. Make cards and presents for family and friends instead of buying them.

There are ways to earn money when needed too. Wash the car, sort the washing, mow the lawn.

I think an understanding of the value of money is so important and perhaps harder than ever to achieve as we do so much online and with cards, children do not always see real money.

I am looking forward to the day that our children open bank accounts. I used to love watching my balance grow in my little red book. We lived in Germany and I would save and save all my weekend job wages so that I would lots of money to spend on return trips to the UK.

When our children open bank accounts we will make an occasion of it. We will go to the bank and deposit real money. We will mark the occasion with a budgeted for cake. We will encourage then to make regular deposits and then we will watch their balances grow and begin to talk to them about interest, about the bank paying them money for being good savers.

A rite of passage for any growing child.

What would your golden nugget of money advice be for your child as they open their first current account?

This post was written in collaboration with TSB